Wharton Global Allocators Summit

Thank you for attending the inaugural Wharton Global Allocators Summit on Friday May 19, 2023, where top allocators from around the world gathered to share insights and best practices on investment strategies and portfolio management. This exclusive event offered a unique opportunity to learn from and engage with some of the most prominent names in the industry.

We uncovered the key challenges, emerging trends and strategic considerations faced by global allocators through open forum and discussion. Highlights from the summit include:

-

- Keynote speeches from industry leaders and renowned experts

- Panel discussions on the latest investment trends and strategies

- Roundtable discussions on specific asset classes and regions

- Opportunities to meet and connect with fellow allocators and investors

Focal themes from the summit include:

-

- The global economic outlook and market trends

- Optimal asset allocation strategies in the current economic context

- The role of alternative investments in asset portfolios

- Emerging technologies and tools available to today’s allocators

- Potential risks and rewards of integrating ESG into allocation decisions

We hope you enjoyed expanding your network, gaining new perspectives on investing, and learning about latest industry developments, at the Wharton Global Allocators Summit.

The Inaugural Wharton Global Allocator Summit

Friday May 19, 2023

8th Floor Jon M. Huntsman Hall

3730 Walnut St., Philadelphia, PA 19104

Conference Theme: Allocations in Changing Times

Dress Code: Business Attire (Ties are optional)

To facilitate an atmosphere of free and productive idea-sharing, we would like to inform you that the Wharton Global Allocators Summit will be a media-free event, and no presentations, conversations or panel discussions will be recorded. However, a photographer will be present to take still photos of the event.

| 08:00 – 09:00 | Networking Breakfast and Registration (60 min) |

| 09:00 – 09:05 | Welcome Remarks (5 min) |

| Ziad Sarkis, Director of Financial Research of the Wharton School’s Harris Family Alternative Investments Program | |

| 09:05 – 09:15 | Introduction to the Harris Program and Overview of the Summit’s Agenda (10 min) |

| Professor Burcu Esmer, Faculty Member and Academic Co-Director of the Wharton School’s Harris Family Alternative Investments Program | |

| 09:15 – 09:35 | Keynote Address: Global Allocations Given Current Geopolitical and Economic Conditions (20 min) |

| Changes in politics at the global level and shifting macroeconomic conditions can have both positive and negative impacts on allocations across asset classes. Mubadala provides their perspective on how these developments have influenced allocations. | |

| Carlos Obeid, Chief Financial Officer of the Mubadala Investment Company | |

| 09:35 – 10:25 | Allocations in Times of Uncertainty (50 min) |

| Expanding on Mubadala’s introductory perspective regarding geopolitical and macroeconomic developments, this panel brings together prominent industry leaders from diverse regions to present contrasting viewpoints. | |

| Moderator: | |

| Ziad Sarkis, Director of Financial Research of the Wharton School’s Harris Family Alternative Investments Program | |

| Panelists: | |

| Thomas Lee, Chief Investment Officer of the New York State Teachers’ Retirement System | |

| Dr. Timo Löyttyniemi, Chief Executive Officer of the State Pension fund of Finland | |

| Ben Samild, Deputy Chief Investment Officer of the Future Fund of Australia | |

| 10:25 – 10:55 | Morning Coffee Break & Networking (30 min) |

| 10:55 – 11:35 | Alternative Investment Funds (40 min) |

| In this discussion, we examine the primary concerns related to over-allocating to private capital funds amid fluctuations in interest rates and stock markets. Additionally, we explore other important considerations that investors must consider when allocating funds to this asset class. | |

| Moderator: | |

| Anna Nekoranec, Chief Executive Officer at Align Private Capital | |

| Panelists: | |

| Kari Vatanen, Chief Investment Officer at Veritas Pension Insurance Company | |

| Pontus von Essen, Head of Strategy at Swedish Pension Fund AP7 | |

| Bradley Ackerman, Head of Alternative Investments at PNC Asset Management | |

| 11:35 – 12:15 | Private Capital in Emerging Markets: Where, When, And How (40 min) |

| When investing private capital in emerging markets, it is crucial to understand the intricacies of these markets and cultivate long-term relationships. We delve into how allocators seeking to invest in such regions can leverage the experience and capabilities offered by development finance institutions and funds-of-funds to their advantage. | |

| Moderator: | |

| Eric Newman, Trustee & Vice Chairman of the Pension Funds of the City of Stamford & the Town of Fairfield | |

| Panelists: | |

| Stephanie Lindemann-Kohrs, Global Head of Equity and Funds at KFW Development Bank, Germany | |

| Amit Chandra, Managing Director at 57 Stars, an emerging markets-focused fund-of-funds manager | |

| 12:15 – 12:35 | Presentation: Slow Moving Capital and Predictability of Stock Returns (20 min) |

| Historically all returns in the US stock market have accrued during just seven days around the turn of the month. | |

| Professor Matti Suominen, Vice-Chair of the Investment Consultative Committee of the State Pension Fund of Finland and Visiting Full Professor of Finance at The Wharton School | |

| 12:35 – 13:35 | Networking Lunch (60 min) |

| 13:35 – 14:25 | Improving Allocation Decisions with Data and Analytics (50 min) |

| Investment decisions around allocations into multiple asset classes rely on established methodologies to assess cash flows and other key indicators. On this panel we discuss tools available to allocators to help them invest more efficiently. | |

| Moderator: | |

| Tobias True, Partner at Adams Street Partners | |

| Panelists: | |

| Winston Ma, Esq., Executive Vice Chairman at Virtual-Q; Ex-Managing Director and Head of North America Office at China Investment Corp (CIC) | |

| Saku Nousiainen, Investment Director at The Alfred P. Sloan Foundation | |

| Patrick Carlevato, Head of Growth at SEI Novus | |

| 14:25 – 14:50 | Presentation: The Effect of Rising Interest Rates and Inflation on Allocations (25 min) |

| Higher interest rates affect leverage and return. An academic perspective sheds light on the historical effects of elevated interest rates on various asset classes and provides insights into their expected future implications. | |

| Professor João Gomes, Howard Butcher III Professor of Finance and Senior Vice Dean of Research, Centers, and Academic Initiatives at the Wharton School | |

| 14:50 – 15:20 | Afternoon Coffee Break & Networking (30 min) |

| 15:20 – 16:05 | Fixed Income, Credit, and Real Assets (45 min) |

| In the past year, the impact of interest rate fluctuations has played a substantial role in driving greater allocations towards fixed income and private credit instruments. Additionally, real assets are increasingly viewed as a reliable hedge against inflation. In this panel discussion, we gain insights from experienced allocators in this asset class. They provide valuable perspectives on key considerations Chief Investment Officers should bear in mind when rebalancing their portfolios. | |

| Moderator: | |

| Lindsay Rosner, Senior Portfolio Manager at PGIM Fixed Income | |

| Panelists: | |

| Timothy Calkins, Co-Chief Investment Officer at Nottingham Advisors | |

| James Smigiel, Chief Investment Officer at SEI | |

| Daniel Shaykevich, Senior Portfolio Manager and Co-Head of the Emerging Markets and Sovereign Debt Team at Vanguard | |

| 16:05 – 16:55 | Building Co-Investing, Secondaries, and GP Stake Programs (50 min) |

| When it comes to accessing private capital funds, there are various strategies that allocators can adopt. In this group discussion, we delve into the best practices for investing beyond conventional primary LP positions. We analyze LP secondaries, continuation funds, co-investments, and GP stakes as alternative approaches to accessing private capital funds. | |

| Moderator: | |

| Jordan Foote, Investment Director at Alberta Investment Management Company | |

| Panelists: | |

| Peter Ammon, Chief Investment Officer at the University of Pennsylvania Endowment | |

| Neha Markle, Head of Alternative Investment Partners (AIP) Private Markets Solutions at Morgan Stanley | |

| Mina Nazemi, Head of Diversified Alternative Equity at Barings | |

| Mo Saraiya, Executive Director at GCM Grosvenor | |

| 16:55 – 17:25 | ESG Investing: Contrasting Opposing Views (30 min) |

| In this group discussion, we explore the contrasting viewpoints surrounding ESG investments. Critics argue that ESG investments prioritize political agendas, such as climate change, over maximizing investor returns. Conversely, proponents of the ESG industry argue that it effectively identifies companies with higher risks beyond traditional investment criteria. These divergent opinions shed light on a disagreement while recognizing the importance of embracing different perspectives. | |

| Moderator: | |

| Professor Kevin Kaiser, Senior Director of the Wharton School’s Harris Family Alternative Investments Program and Adjunct Full Professor of Finance at the Wharton School’s Finance Department | |

| Panelists: | |

| Dr. Daniel Walker, Board Member at the California Endowment | |

| Erika Gucfa, Managing Director at North Sky Capital | |

| 17:25 – 17:30 | Closing Remarks (5 min) |

| Ziad Sarkis, Director of Financial Research of the Wharton School’s Harris Family Alternative Investments Program | |

| 17:30 – 18:30 | Drinks & Reception (60 min) |

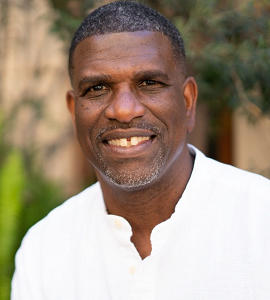

KEYNOTE SPEAKER

Carlos Obeid

Chief Financial Officer

Mubadala Investment Company

https://www.mubadala.com/en/who-we-are/investment-committee/carlos-obeid

SPEAKERS

Bradley Ackerman

Head of Alternative Investments

PNC Asset Management

Peter Ammon

Chief Investment Officer

University of Pennylvania Investment Office

Timothy Calkins

Co-Chief Investment Officer

Nottingham Advisors

Burcu Esmer

Co-Director, Harris Family Alternative Investments Program & Snr. Lecturer of Finance

Harris Family Alternative Investments Program

Jordan Foote

Director

Alberta Investment Management Company (AIMCo)

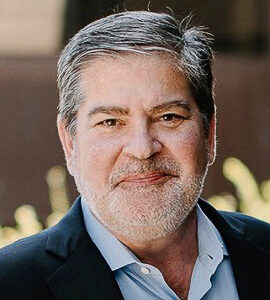

Kevin Kaiser

Senior Director, The Harris Family Alternative Investments Program,

Adjunct Full Professor of Finance, Wharton Finance Department

Thomas Lee

Executive Director and Chief Investment Officer

New York State Teachers’ Retirement System

Stephanie Lindemann-Kohrs

Global Head of Equity and Funds

KFW Development Bank

https://www.linkedin.com/in/stephanie-lindemann-kohrs-b38b181a/

Timo Löyttyniemi

Chief Executive Officer

State Pension fund of Finland

Winston Ma

Executive Vice Chairman, Virtual-Q; Ex-Managing Director and Head of North America Office

China Investment Corp (CIC)

Neha Markle

Head of Alternative Investment Partners (AIP) Private Markets Solutions

Morgan Stanley

Mina Nazemi

Head of Diversified Alternative Equity

Barings

Anna Nekoranec

Chief Executive Officer

Align Private Capital LLC

Eric Newman

Trustee & Vice Chairman

City of Stamford & Town of Fairfield

Saku Peter Nousiainen

Investment Director

Alfred P. Sloan Foundation

Lindsay Rosner

Senior Portfolio Manager

PGIM Fixed Income

Ben Samild

Deputy Chief Investment Officer

The Future Fund (Australia’s Sovereign Wealth Fund)

Ziad Sarkis

Director of Financial Research, The Harris Alternative Investments Program

The Wharton School

Daniel Shaykevich

Senior Portfolio Manager & Co-head of the Emerging Markets and Sovereign Debt Team

Vanguard

Matti Suominen

Professor at Aalto University & Visiting Professor at Wharton

Kari Vatanen

Chief Investment Officer

Veritas Pension Insurance Company

ATTENDEES

Michael Alharir

Chief Executive Officer

Silkmann Properties (Family Office)

Luis Barros

Lecturer, Alternative Investments & Global Entrepreneurship Labs

Massachussets Institute of Technology

Thomas Bauer

Deputy Chief Investment Officer

Pennsylvania Public School Employees’ Retirement System (PA PSERS)

Simon Beauroy

Director, Strategic Developments, Sovereign Investment Partnerships & Long-Term Investors

bpifrance

Naji Boutros

Managing Partner

Tavis Capital AG

Thomas Bouvier

Investment Director

bpifrance

Samantha Choa

Senior Product Strategist

Vanguard

Benjamin Cotton

Chief Investment Officer

Pennsylvania Public School Employees’ Retirement System (PA PSERS)

Sancia Dalley

Senior Vice President

Robert F. Kennedy Foundation

Robert Daugherty

Principal

Acer Springs Capital (Family Office)

Riikka Davidkin

Director, Impact Investments

Social Finance

Russell Deakin

Chief Investment Officer

Aceana Group (Family Office)

Kristen DePre

Vice President, Institutional Client Management (Not for Profit and Endowment Practice)

PIMCO

Katrina Dudley

SVP, Investment Strategist

Franklin Templeton

Boris Erenburg

Managing Partner

Arpoador Invest (Family Office)

Marc Esen

Co-Chief Investment Officer

Montgomery County Employee Retirement Plans

Cedric Fan

Senior Portfolio Manager

Russell Investment Group

David Fisher

Principal

Kifo US (Kirsch Family Office)

Adam Fried

Founding Partner

Friedom Partners (Family Office)

Florentina Furtuna

Associate Director

Barings

Stacey Gilbert

Chief Investment Officer

Glenmede Investment Management

Alex Goins

Senior Vice President & Head of Alternative Investments

Lincoln Financial Group

Mateo Goldman

Managing Director

DFC

Gustavo Gomberg

Director, DCIO Portfolio Construction Office

Future Fund

Alex Gurvich

Director of Investment Research

PFM Asset Management (A subsidiary of US Bank)

Patrick Hop

Managing Partner

Titan Point Capital (Family Office)

Yahya Jalil

Managing Director International Investments

RIMCO Investment LLC, a subsidiary of Al Rashed Group (Family Office)

David Katz

Head of Institutional/Senior Managing Director

Virtus Investment Partners

Sean Kerins

Co-Head of Traditional Strategies Due Diligence

PNC Asset Management

Christina Kim

Head of Partnerships

Girls Who Invest

Vincent Kravec

Managing Director

Commonfund

Antonios Kypreos

Partner

Axion Financial Group (Family Office)

Amy Lai

Vice President, Investments

Albert B. Glickman Family Foundation (Family Office)

Mike Lucarelli

Partner

Adams Street Partners

Justin Maistrow

Deputy Chief Investment Officer

State of Rhode Island

Akshay Mansukhani

Managing Partner

Malabar Invest (Family Office)

Mohammad Masoud

Investment Director

Madr Investment Company (Family Office)

Kevin Meyers

Chief Investment Officer

First Haven Capital (Family Office)

Greg Millhauser

Managing Director & Portfolio Manager, Private Investments

Glenmede

Robert Nelson

Senior Alternative Investments Specialist

Mercer

Martin Ngombwa

Vice President

The Public Investment Fund

Karn Nopany

Head of Alternatives & Non-Core Specialty Mandates

Enstar Group

Tuomas Olkku

Executive Director

KAUTE Foundation

Jonathan Rabinow

Chief Investment Officer

Lightstone Investments (Family Office)

Jay Ramakrishnan

MD, Head of Originations & Founding Member, AB Private Credit Investors

Alliance Bernstein

Lauren Rich

Managing Director

Wafra

Richard Rincon

Founding Partner

Cypress Creek Partners

Kashish Shah

Partner

Marwar Capital (Family Office)

Abhishek Sharma

Chief Executive Officer

Foundation Holdings (Family Office)

Randall Shu

Director of Investments

Melville Management Corporation (Family Office)

Deborah Spalding

Chief Investment Officer

Commonfund

Jared Speicher

Head of North American Buyout

Metlife Investment Management

John Trammell

Partner

Symphony Financial Partners

Jim Treanor

Deputy Chief Investment Officer

Florida State Board of Administration

Cathy Ulozas

Chief Investment Officer

Drexel University

Lauri Vaittinen

Chief Executive Officer

Mandatum Asset Management

Drew von Glahn

Executive Director

Collaborative for Frontier Finance

Rennie Zhang

Director, Investment Management

AARP

![]()